Hosting car title loan community outreach fairs requires tailoring services to unique community needs, especially for those with limited credit history and access to traditional banking. These events offer educational resources on alternative financing options, empower individuals with financial literacy knowledge, dispel myths, clarify regulations, and provide workshops on credit score building for long-term stability. Successful planning involves strategic targeting, interactive activities, clear communication, personalized consultations, local partnerships, smooth logistics, and multi-channel promotion. During events, prioritize excellent customer service by simplifying loan processes, conducting thorough vehicle inspections, addressing concerns promptly, and offering on-site application processing.

Hosting car title loan community outreach fairs and clinics is a powerful strategy to engage with underserved populations. By understanding their unique financial needs, these events can provide valuable resources and education on short-term lending options. This article delves into the critical components of successful outreach—from identifying target communities to implementing clinic strategies that foster trust and accessibility. Learn how these events can serve as transformative gateways to economic empowerment.

- Understanding Car Title Loan Outreach Needs

- Planning Effective Community Events

- Strategies for Successful Clinic Implementations

Understanding Car Title Loan Outreach Needs

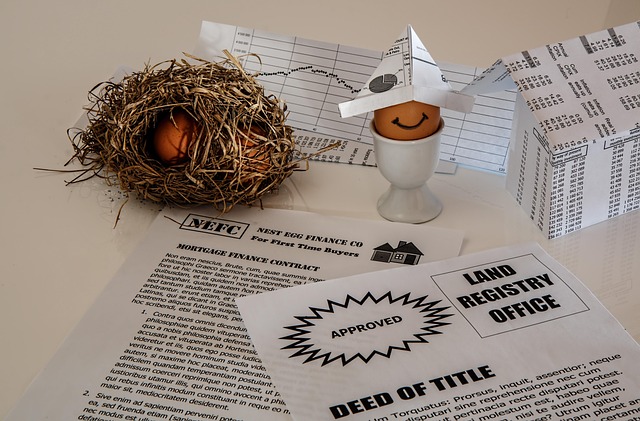

Hosting Car Title Loan Community Outreach Fairs and Clinics requires a deep understanding of the unique needs within each community they serve. These events are designed to provide accessible, educational resources about alternative financing options, especially for those with limited or no credit history. In many cases, low-income communities often lack access to traditional banking services, leaving them vulnerable during times of financial emergencies. Car title loans, such as those offered by Dallas Title Loans and Fort Worth Loans, can serve as a bridge for these folks to secure emergency funds quickly.

By organizing these outreach fairs, financial institutions have the opportunity to dispel myths about car title loans, clarify regulations, and highlight their role in community economic empowerment. They can also offer workshops on financial literacy, budgeting, and credit score building. Such initiatives not only address immediate financial needs but also empower individuals with knowledge that promotes long-term financial stability.

Planning Effective Community Events

Planning effective community outreach events for car title loan services involves a strategic approach to engage and educate potential borrowers. Start by identifying target communities with a high need for financial assistance, such as neighborhoods facing high unemployment rates or areas with limited access to traditional credit options. This targeted selection ensures that your event is relevant and impactful.

Create an agenda that balances informative sessions with interactive activities. Educate attendees about car title loans, their benefits, and how they can help with debt consolidation or financial emergencies. Use simple language and visual aids to make complex concepts understandable. Offer one-on-one consultations where participants can discuss their specific situations and receive personalized advice. Additionally, consider partnerships with local non-profits or community centers to co-host, leveraging their networks and resources for a larger reach. Ensure smooth event flow by assigning roles, pre-registering attendees, and preparing necessary materials to create a seamless experience for all.

Strategies for Successful Clinic Implementations

Hosting Car Title Loan Community Outreach Fairs and Clinics requires strategic planning for successful implementation. Firstly, identify target communities through demographic analysis and local partnerships with community organizations. This ensures that the events reach those most likely to benefit from car title loan services. Secondly, promote the clinics well in advance using a multi-channel approach: social media, local newspapers, community bulletin boards, and word-of-mouth referrals.

During the clinic, focus on providing an excellent customer experience. Offer clear explanations of car title loan processes, terms, and conditions using simple language, avoiding complex jargon. Conduct thorough vehicle inspections to accurately assess loan eligibility and provide financial solutions tailored to attendees’ needs. Encourage open communication by addressing concerns and questions promptly. Additionally, consider offering on-site application processing and approval, facilitating quick access to funds through loan extensions for those who qualify.

Hosting car title loan community outreach fairs and clinics is a powerful strategy to connect with borrowers, build trust, and promote financial literacy. By understanding specific outreach needs, planning engaging events, and implementing successful clinic practices, lenders can foster meaningful interactions and offer much-needed services. Car title loan community outreach initiatives enhance borrower well-being and contribute to a more informed and stable financial environment.